Introduction: Investing Without Paying a Sales Commission

When people start investing in mutual funds, one of the first questions they encounter is about fees. Some mutual funds charge sales commissions, while others do not. These commissions can quietly reduce your investment returns before your money even has a chance to grow.

This is where no-load mutual funds come in.

No-load mutual funds are designed to give investors a simpler, more cost-efficient way to invest. In this article, we’ll explain what no-load mutual funds are, how they work, and why many long-term investors prefer them.

Definition of No-Load Mutual Funds

A no-load mutual fund is a mutual fund that does not charge a sales commission (also known as a “load”) when you buy or sell shares.

This means:

- 100% of your investment goes into the fund

- You are not paying a broker’s sales fee

- You can enter and exit the fund without commission penalties

No-load funds focus on performance and efficiency rather than distribution fees.

Understanding “Load” in Mutual Funds

A “load” is a commission paid to a broker or financial advisor for selling a mutual fund.

Common Types of Loads

- Front-end load: Paid when you buy the fund

- Back-end load: Paid when you sell the fund

- Deferred load: Decreases the longer you hold the fund

No-load funds eliminate all of these sales charges.

How No-Load Mutual Funds Work

No-load funds are usually sold:

- Directly by fund companies

- Through online brokerage platforms

- Inside retirement accounts

Because there is no commission, fund companies rely on:

- Low expense ratios

- Scale

- Long-term investor relationships

This aligns fund success more closely with investor success.

No-Load Funds vs. Load Funds

The key difference is cost.

| Feature | No-Load Funds | Load Funds |

|---|---|---|

| Sales commission | None | Yes |

| Initial investment | Fully invested | Reduced by fees |

| Flexibility | High | Limited |

| Transparency | Clear | Often complex |

Over time, these differences can significantly affect returns.

Why Investors Choose No-Load Mutual Funds

Lower Costs

No-load funds eliminate unnecessary fees that reduce compounding power.

Immediate Compounding

Because your full investment is working from day one, compounding begins immediately.

Flexibility

Investors can:

- Rebalance portfolios easily

- Add or withdraw funds without penalties

- Adjust strategies as goals change

Transparency

No-load funds are easier to:

- Understand

- Compare

- Evaluate

Simple structures favor informed decisions.

Are No-Load Mutual Funds Cheaper Overall?

Often—but not always.

Investors should still review:

- Expense ratios

- Management fees

- Turnover costs

A no-load fund with a high expense ratio can still be expensive. The goal is low total cost, not just “no commission.”

No-Load Funds and Index Investing

Many no-load funds are index funds that:

- Track market benchmarks

- Minimize trading

- Keep costs low

These funds are popular because they:

- Offer diversification

- Reduce management risk

- Provide consistent market exposure

Index no-load funds are widely used in retirement planning.

No-Load Funds for Long-Term Investors

No-load mutual funds are ideal for:

- Retirement accounts

- Dollar-cost averaging

- Long-term wealth building

They support disciplined investing without friction from sales fees.

Common Myths About No-Load Mutual Funds

“No-load means low quality”

False. Many top-performing funds are no-load.

“You don’t get advice”

Advice can still be obtained separately—without commissions.

“They’re only for experienced investors”

No-load funds are often more beginner-friendly due to simplicity.

How to Buy No-Load Mutual Funds

You can purchase no-load funds through:

- Online brokerages

- Directly from fund providers

- Employer-sponsored retirement plans

Most platforms provide tools to:

- Compare funds

- Review performance

- Analyze costs

Access has never been easier.

When No-Load Funds Might Not Be Ideal

In some cases, investors may prefer:

- Full-service advisory relationships

- Comprehensive financial planning

Even then, many advisors now use no-load funds due to their efficiency.

Final Thoughts: Simplicity and Efficiency Matter

No-load mutual funds remove unnecessary friction from investing.

They allow investors to:

- Keep more of their money invested

- Focus on long-term goals

- Avoid conflicts of interest

- Benefit fully from compounding

You don’t need complex products to build wealth—you need low costs, consistency, and patience.

For many investors, no-load mutual funds offer exactly that.

Word Count:

810

Summary:

No load mutual funds are mutual funds whose shares are sold without a commission or sales charge. The reason for this is that the shares are distributed directly by the investment company, instead of going through a secondary party. This is the opposite of a load fund, which charges a commission upon the initial purchase at the time of sale.

Keywords:

mutual funds, mutual funds loads, no-load mutual funds, no load mutual funds

Article Body:

Copyright 2006 Michael Saville

No load mutual funds are mutual funds whose shares are sold without a commission or sales charge. The reason for this is that the shares are distributed directly by the investment company, instead of going through a secondary party. This is the opposite of a load fund, which charges a commission upon the initial purchase at the time of sale.

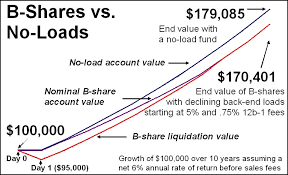

Since there is no cost for you to enter a no-load fund, all of your money is working for you. If you purchase $10,000 worth of a no-load mutual fund, all $10,000 will be invested into the fund. On the other hand, if you buy a load fund that charges a commission of 5% upon purchase, the amount actually invested in the fund is $9,500. If both funds return 10%, the no-load fund would have grown to $11,000 while the loaded fund only rose to $10,450.

The major idea behind a load fund is that you will make up what you paid in commissions with the solid returns that the managers will provide. However, most studies show that loads don’t outperform no-loads.

Most load mutual funds are sold through brokerage houses, financial planners, and people known as “Registered Representatives.” With very few exceptions, most of these people operate on the basis of selling as many fund shares as possible. Their commissions are collected up front, as a back end charge, or both. Whether you make money or lose it isn’t their primary concern. What matters most to these folks is how often you buy (and generate new commissions for them).

No load funds have traditionally been marketed directly by the mutual fund companies themselves. But today, more and more funds are being offered through discount houses like Fidelity, Schwab, and a host of others. The advantage to this is that you have an unlimited choice of mutual funds in one place. You don’t have to open a separate account for each mutual fund family that you purchase.

Most fee based investment advisors have independent relationships with the major discount firms. They’re able to offer clients just about any no load mutual fund that is available. They receive no commissions from the firm and only get paid by the client according to a pre-determined fee arrangement. Under this type of arrangement, there’s no hidden agenda to try to sell you a particular mutual fund in order to earn a larger commission.

It is best to stick with no-load or low-load funds, but they are becoming more difficult to distinguish from heavily loaded funds. The use of high front-end loads has declined, and funds are now turning to other kinds of charges. Some mutual funds sold by brokerage firms, for example, have lowered their front-end loads to 5%, and others have introduced back-end loads (deferred sales charges), which are sales commissions paid when exiting the fund. In both instances, the load is often accompanied by annual charges.

On the other hand, some no-load funds have found that to compete, they must market themselves much more aggressively. To do so, they have introduced charges of their own.

The result has been the introduction of low loads, redemption fees, and annual charges. Low loads–up to 3%–are sometimes added instead of the annual charges. In addition, some funds have instituted a charge for investing or withdrawing money.

Redemption fees work like back-end loads: You pay a percentage of the value of your fund when you get out. Loads are on the amount you have invested, while redemption fees are calculated against the value of your fund assets. Some funds have sliding scale redemption fees, so that the longer you remain invested, the lower the charge when you leave. Some funds use redemption fees to discourage short-term trading, a policy that is designed to protect longer-term investors. These funds usually have redemption fees that disappear after six months.

Probably the most confusing charge is the annual charge, the 12b-1 plan. The adoption of a 12b-1 plan by a fund permits the adviser to use fund assets to pay for distribution costs, including advertising, distribution of fund literature such as prospectuses and annual reports, and sales commissions paid to brokers. Some funds use 12b-1 plans as masked load charges: They levy very high rates on the fund and use the money to pay brokers to sell the fund. Since the charge is annual and based on the value of the investment, this can result in a total cost to a long-term investor that exceeds a high up-front sales load. A fee table is required in all prospectuses to clarify the impact of a 12b-1 plan and other charges.

The fee table makes the comparison of total expenses among funds easier. Selecting a fund based solely on expenses, including loads and charges, will not give you optimal results, but avoiding funds with high expenses and unnecessary charges is important for long-term performance.

Tinggalkan Balasan