Introduction: Small Fees Can Create Big Losses

When it comes to investing, most people focus on performance—returns, market timing, and winning strategies. But one of the biggest factors affecting long-term investment success is cost.

Many investors don’t realize that the fees they pay can quietly eat away at their returns year after year. This is where no-load funds stand out.

No-load funds are designed to help investors keep more of their money working for them. In this article, we’ll explain what no-load funds are, how they work, and why buying no-load funds can be a smarter investment decision over the long run.

What Are No-Load Funds?

A no-load fund is a mutual fund that does not charge a sales commission, also known as a “load.”

Traditional mutual funds may charge:

- Front-end loads (fees paid when you buy)

- Back-end loads (fees paid when you sell)

- Deferred sales charges

No-load funds eliminate these commissions entirely.

This means:

- 100% of your money goes into the investment

- You are not paying a salesperson to access the fund

Understanding Load vs. No-Load Funds

Load Funds

Load funds typically:

- Pay commissions to brokers or advisors

- Reduce your initial investment

- Increase the break-even point

Example:

If you invest $10,000 with a 5% front-end load, only $9,500 is actually invested.

No-Load Funds

No-load funds:

- Do not charge sales commissions

- Are often sold directly to investors

- Focus on performance and efficiency

From day one, your full investment is working for you.

Why Fees Matter More Than You Think

Fees compound just like returns—but in the opposite direction.

A difference of even 1% per year in costs can result in:

- Tens of thousands of dollars lost over decades

- Lower retirement balances

- Slower wealth accumulation

No-load funds help reduce unnecessary costs that provide no performance advantage.

Performance: No-Load Funds vs. Load Funds

Many investors assume load funds perform better because they are “professionally sold.” In reality:

- Numerous studies show no consistent performance advantage for load funds

- Many top-performing mutual funds are no-load funds

- Lower costs often lead to better net returns

You are not paying for better performance—you’re paying for distribution.

Transparency and Investor Control

No-load funds are often:

- More transparent

- Easier to compare

- Less complicated

Investors can:

- Buy and sell without penalty

- Adjust portfolios freely

- Focus on strategy instead of timing fees

This flexibility is especially valuable in changing markets.

Ideal for Long-Term Investors

No-load funds are particularly well-suited for:

- Retirement investing

- Dollar-cost averaging

- Long-term wealth building

Because there are no sales charges:

- Contributions are more efficient

- Rebalancing is cheaper

- Long-term compounding works faster

Time and consistency matter more than sales pitches.

No-Load Funds and Index Investing

Many no-load funds are:

- Index funds

- Passively managed

- Low expense ratio funds

These funds:

- Track market benchmarks

- Avoid excessive trading

- Keep costs extremely low

For investors who believe in market efficiency, no-load index funds are a natural fit.

Lower Costs, Less Pressure

With load funds, investors may feel:

- Locked in due to sales charges

- Pressured to hold underperforming funds

- Reluctant to rebalance

No-load funds remove that pressure, allowing decisions to be made based on:

- Performance

- Asset allocation

- Risk tolerance

Not commissions.

Are No-Load Funds Always Better?

Not automatically—but often.

Investors should still consider:

- Expense ratios

- Fund management quality

- Investment strategy

- Long-term consistency

A no-load fund with high ongoing expenses may still be costly. The goal is low total cost, not just no commission.

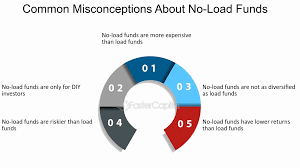

Common Myths About No-Load Funds

“No-load funds are lower quality”

False. Many are managed by top investment firms.

“You need an advisor to invest properly”

Not always. Education and discipline matter more than commissions.

“Load funds give better advice”

Advice quality depends on the advisor—not the fee structure.

How to Buy No-Load Funds

No-load funds can be purchased through:

- Direct fund companies

- Online brokerage platforms

- Retirement accounts (401(k), IRA)

Most platforms make it easy to:

- Compare funds

- Review expenses

- Analyze performance

Access has never been easier.

The Psychological Advantage of No-Load Investing

Knowing you are not paying commissions:

- Builds confidence

- Reduces regret

- Encourages long-term thinking

Investors are more likely to stay disciplined when costs are simple and transparent.

When Load Funds Might Make Sense

In rare cases, load funds may be considered if:

- You receive comprehensive, ongoing financial planning

- The advisor adds measurable value

- Fees are clearly justified

Even then, total cost should be carefully evaluated.

Final Thoughts: Keep More of What You Earn

Investing is not just about making money—it’s about keeping it.

No-load funds help investors:

- Reduce unnecessary fees

- Improve long-term returns

- Stay flexible and disciplined

- Focus on strategy, not commissions

Over time, lower costs can make a bigger difference than trying to beat the market.

If your goal is long-term wealth building, buying no-load funds is one of the simplest and smartest decisions you can make.

Word Count:

572

Summary:

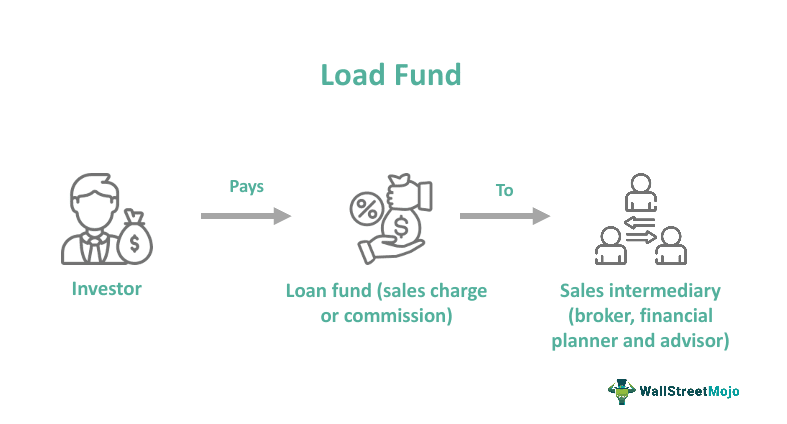

Load is defined as the fee or the commission that an investor pays to a mutual fund at the time of purchasing or redeeming the shares of the mutual fund.If the commission is charged when the investor buys the shares, it is known as a front-end load. On the other hand if the commission is charged when the investors redeems his shares, it is known as a back-end load.

Keywords:

Mutual Funds

Article Body:

Load is defined as the fee or the commission that an investor pays to a mutual fund at the time of purchasing or redeeming the shares of the mutual fund.

If the commission is charged when the investor buys the shares, it is known as a front-end load. On the other hand if the commission is charged when the investors redeems his shares, it is known as a back-end load.

Certain funds apply back-end loads only if the shares are redeemed within a specific time period after being bought.

The argument for applying loads on mutual fund transactions is that these loads will discourage investors from trading frequently in mutual funds. If the investors quickly move in and out of mutual funds, the funds have to maintain a high cash position to meet these redemptions, which in turn decreases the returns of the funds.

Also frequent trading means the expenses of the mutual funds go up.

There are various arguments against load funds:

-The fees that the mutual funds collect as loads are passed on to the fund brokers. The loads do not provide any incentive for the fund manager for better performance of the funds. In other words, a load fund has no reason why its managers should perform better than those of no-load funds.

-In the last few decades, no difference has been seen in the returns of load and no-load funds (if the loads are not considered.) When the loads are considered, the investors of load funds have actually gained less than the investors of no-load funds.

-When a sales person knows that he is going to get a commission from a load fund, he tends to push the load fund more – even when the load funds are performing poorly as compared to no-load funds.

-Loads are understated by mutual funds. If an investor invests $1000 in a fund with 5% front-end load, the actual investment is only $950. Thus his actual load is $50 in $950 investment – a 5.26% load.

If an investor is already invested in a load fund, it doesn�t make sense to exit now. The load has already been paid for. The hold or sell decision should now only be based on what the investor thinks about the future performance of the fund. In a few funds, the exit load depends on the period for which the fund was held. Check the details of the fund prospectus for more information.

In most cases it is better to avoid load funds; however, investors should keep one thing in mind. Sometimes load funds can be a better choice than no-load funds. For example, an investor has a choice of two classes in a fund – class A and class B. Class A has 3% front-end load and Class B has no load. The investor however misses the fine print, which states that Class B has 1% 12b-1 annual fees.

If the fund will make 10% gains each year, its return in Class A (starting with actual amount invested $970) will be

($970) X (1.10) X (1.10) X (1.10) X (1.10) X (1.10) = $1562

For Class B, the returns will be

($1000) X (1.10) X (0.99) X (1.10) X (0.99) X (1.10) X (0.99) X (1.10) X (0.99) X (1.10) X (0.99) = $1532.

Thus the above example is an exception, where in the long run, the load fund will perform better than the no-load fund (with 12b-1 fees).

The fact is that a no-load fund cannot be considered a true no-load fund, if it charges fees from it’s investors in the form of 12b-1 and other fees.

Tinggalkan Balasan